Why You Should Fear a MAGAfied Fed

The next Fed chair will debase himself for Trump

Jerome Powell’s term as chairman of the Federal Reserve Board will end in May 2026. We don’t know who Donald Trump will choose to replace him, but we already know that his successor will be a disaster.

How can I say that without knowing who will get the nod? By invoking Bessent’s Law.

Let me explain. What Trump looks for in his personnel choices is, above all, groveling loyalty. So anyone he chooses will, more or less by definition, be a spineless toady. Even if the appointee looks qualified for the position, we can be sure that he or she will indulge and cheer on every Trump idea, no matter how bad. If they weren’t that kind of person, Trump wouldn’t have chosen them. At this point the mere fact that someone is willing to work for Trump, knowing who he is, tells you that they’re willing to debase themselves.

I call this Bessent’s Law because when Trump chose Scott Bessent as Treasury secretary a number of Wall Street people assured us that he was a good, competent choice, someone who would promote sensible policies. But Trump knew his man. In office, Bessent has enthusiastically backed every bit of Trumpian nonsense: Tax cuts pay for themselves, critics of Trump’s trade policy are suffering from “tariff derangement syndrome,” a trillion-dollar reduction in Medicaid isn’t really a benefits cut. Oh, and anyone doing serious analysis of Trump’s policies is just an angry partisan.

So it doesn’t really matter whether the next Fed chair is Kevin Warsh, Kevin Hassett, Larry Kudlow or the My Pillow guy. For practical purposes Trump will be running the Fed.

To explain why this should worry everyone, a brief refresher on what the Fed does and why it matters.

Without getting into the weeds, when we talk about “monetary policy” we’re mostly talking about the Fed’s ability to determine very short-term interest rates like the Federal funds rate, the rate at which banks lend to each other overnight. These very-short-term rates don’t have much direct effect on the economy, but longer-term rates — which affect borrowing and spending decisions — reflect investor expectations about future Fed funds rates. As a result, the Fed usually has a lot of influence over how hot the economy runs.

What the Fed aims for is Goldilocks: An economy that is neither too hot — which can lead to excessive inflation — nor too cold — which can lead to high unemployment.

It’s not an easy job, because the economy is always changing and being hit by new shocks. So the Fed often gets it wrong. Here’s the history of the Fed funds rate since 2000:

You can see the tracks of two significant cases of getting it wrong in that history. In the second half of the 2010s the Fed hiked rates in the belief that the economy was on the verge of overheating; it wasn’t, and the Fed brought rates down again. In 2021-22 the Fed was caught off guard by the post-Covid surge in inflation, and was forced to rapidly hike rates in a (successful) attempt to get inflation back under control.

So the people running the Fed are human and make mistakes. But they’re well-informed, apolitical technocrats doing the best they can, and there’s a longstanding tradition of respecting the Fed’s independence. For the big problem with monetary policy is that it’s too easy to abuse. You don’t want interest rates set by politicians who don’t know the facts, don’t understand the issues, and want the political benefits of low rates.

And you really, really don’t want someone like Donald Trump controlling monetary policy.

Let me acknowledge that the Fed may be making a mistake by keeping rates too high for too long. But there’s also a good case for waiting before making any more rate cuts. As I wrote a few weeks ago, it’s a complicated situation made more complex by Trump’s erratic policies.

There is, however, no plausible case for claiming, as Trump did Wednesday, that the Fed funds rate is 3 points too high. And then there’s this, from yesterday:

The economy is booming, so the Fed should cut rates? Huh? That doesn’t make any sense, EVEN IF YOU SAY IT IN ALL CAPS.

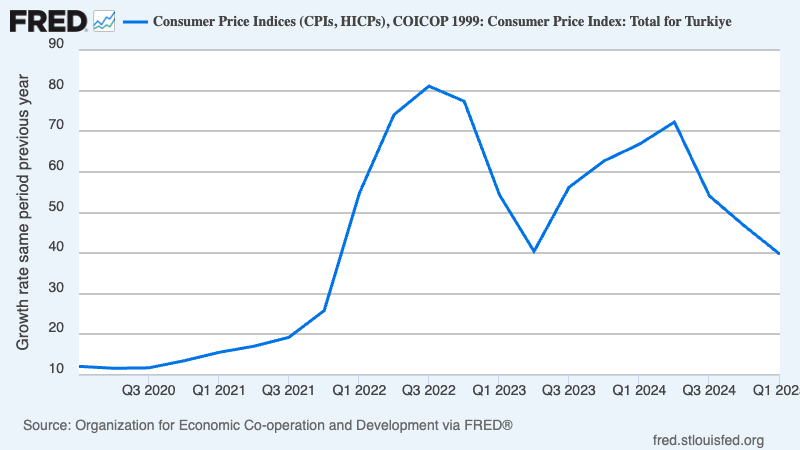

At this point Trump seems determined to emulate another autocrat, Turkey’s Recep Tayyip Erdoğan, who decided that he was an expert on monetary policy and forced his central bank to keep rates low despite rising inflation. The result, shown at the top of this post, was not just high but runaway inflation. In the end, Turkey was forced to raise interest rates to 50 percent:

In fact, let me make a prediction: Trump may initially force the Fed to cut short-term interest rates, but quite soon long-term interest rates will go up, not down, because forward-looking investors will realize that politicized monetary policy is feeding inflation, and even a Trumpified Fed will eventually be forced to raise rates to contain the damage.

Let me acknowledge that so far markets aren’t pricing in the Turkey-style inflation that, it seems to me, is almost inevitable once Trump gets to replace Powell. As far as I can tell, TACO — Trump always chickens out — rules the narrative on inflation, just as it does on tariffs.

But people should read Trump’s Truth Social posts and ask whether he really sounds like someone who will behave sensibly in the end.

Addendum: And now Russell Vought, the White House budget director, is accusing Powell of mismanaging the Fed’s own budget. Does anyone believe that this reflects serious concerns, as opposed to an attempt to intimidate?

MUSICAL CODA

A real shortage of good songs about the Fed funds rate. But I didn’t have music with my recent Brazil post.

Trump has lived, existed and relied on borrowed money. That was when he could find any one who was foolish enough to lend it to him. Most of his ventures and projects have shown that he does not and has not understood any basic rules of business and finance. I remember when he drove out an analyst who pointed out that his debt offering for one his casino projects would not survive at the interest rates and leverage he had put on the casino. By the way eventually the bond holders were the ones that lost out. His business record has been abysmal and his understanding of finance and the economy lacking. Once he gets his hands on the Fed we can expect to see not only more financial chaos but an economic contraction. He has no strategy or understanding this is a government being run on the day to day on his instincts and his needs to be the head line.

Watching from the outside, it’s just CRAZY that your Presidents get to choose all the people who run things - including the justices on the Supreme Court. I can’t see how that’s meant to fit with separation of the powers, let alone contribute to stability…

…and evidently it doesn’t. It’s like watching a race to the bottom, and it’s infecting countries like the UK. Funded of course by the rich individuals and corporations who never pay their taxes, but instead spend on political influence, to stitch things up to suit themselves.

And that’s not to mention the poor mid-ranking civil servants who have dedicated their lives to trying to do the right thing, often with very little recompense (and a huge weight of responsibility). They are thrown on the scrapheap while the pirates fleece the nation…