Why the Fed is on Hold

Trump, Powell and the fog of inflation

Cautious, not stupid

Donald Trump got something right this week. Declaring that Jerome Powell, the Federal Reserve chair, is a “stupid person,” Trump predicted that the Fed wouldn’t cut interest rates at this week’s meeting. And he was correct! He was also correct to point out that the European Central Bank, which is to the euro what the Fed is to the dollar, has repeatedly cut rates while the Fed hasn’t.

Anyway, Powell isn’t stupid. Nor is he, as Trump also said, “a political guy” who’s keeping rates high to punish MAGA, or something. Of course, interest rate policy does have political effects, which Trump knows perfectly well. You may recall that back in 2024 he warned Powell not to cut interest rates before the election — because when it comes to Trump, every accusation is actually a confession.

But the reason Powell isn’t cutting rates now is that the Fed is in a difficult position, largely thanks to, you guessed it, Trump himself, with an assist from the ghost of Arthur Burns (I’ll explain later.)

It occurred to me, reading Trump’s insults, that I haven’t seen many simple explanations of the dilemmas the Fed now faces — again, largely thanks to Trump himself. So I thought I might go a bit wonkier than usual and try to explain why the Fed is on hold for the time being.

The basics: By buying or selling short-term U.S. government debt, the Fed can effectively control short-term interest rates. Strictly speaking, all it controls is the federal funds rate, the interest rate at which banks lend money to each other overnight. But this rate has a lot of influence on longer-term rates, which in turn affect the real economy by affecting housing construction, business investment and so on.

In setting rates, the Fed has a “dual mandate”: full employment and price stability. These days full employment is normally interpreted to mean an official unemployment rate of around 4 percent, which is low enough that most people can easily find jobs but not so low that the economy overheats. Price stability is interpreted to mean inflation low enough that people don’t think about it much, but not zero inflation, which turns out to create some technical problems for economic management.

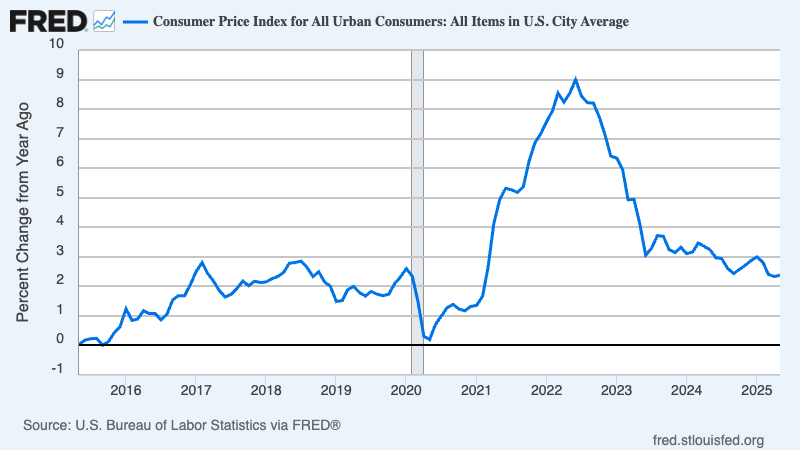

Now, the Fed was way off its target from 2021 to 2023, when inflation surged in the United States (and in almost every nation.) President Biden and his party paid a high price for that inflation surge, which is surely the main reason Trump won the 2024 election. But the surge was transitory. Trump inherited a “Goldilocks” economy in inflation had subsided without the protracted high unemployment some economists (but not me!) claimed was necessary:

The Fed, however, had raised interest rates a lot to fight that inflation surge, so one might have expected a series of rate cuts now that the inflation issue is largely behind us. And Trump might well be riding high in the polls if he had just left the economy alone and taken credit for Biden’s victory over inflation.

Instead, however, he went wild on tariffs.

On April 2 — Liberation Day, in MAGAspeak — Trump imposed huge tariffs on almost every nation. He has modified those tariffs several times since then, but it’s deeply misleading to say, as all too many news reports do, that the tariffs were “paused.” They were reshuffled, with lower tariffs on some countries and goods but higher tariffs on others, but the overall picture remains a leap in average tariffs to levels not seen for 90 years:

Source: Yale Budget Lab

This tariff surge creates big problems for at least one and possibly both sides of the Fed’s dual mandate.

What we know for sure is that the tariffs will cause a large jump in consumer prices. That jump isn’t visible in official price data yet, partly because many businesses rushed to hoard foreign goods before the tariffs kicked in and are still meeting consumer demand out of those stockpiles. But the big price hikes are already happening, and will become obvious to everyone over the next few months.

It's true that Trump continues to insist that tariffs won’t raise prices, that foreigners will pay them. But this is nonsense. Imagine that a Democratic president were to impose a 15 percent sales tax on every good made in America. Would Trump say “This won’t raise prices, because businesses will absorb the tax”? Of course not. So why imagine that foreign businesses will absorb the cost of tariffs, which are nothing but sales taxes on goods made abroad?

The only coherent argument against a large inflationary hit from tariffs was the claim that tariffs would push up the value of the dollar against other countries’ currencies, which would in turn reduce the prices of their goods measured in dollar terms. Both Scott Bessent, the Treasury secretary, and Stephen Miran, chair of the Council of Economic Advisers, made this argument before the big Trump tariffs went into effect.

But the dollar has, in fact, gone down rather than up:

This decline reflects a general loss of confidence in American stability and reliability. But that’s another discussion. What it means for the Fed is that yes, Trump’s tariffs are about to cause a major inflationary hit.

And the Fed isn’t going to cut interest rates in the face of surging inflation. My guess is that Trump has never heard of Arthur Burns, who led the Fed under Richard Nixon. But the Fed remembers. Burns is often accused of having kept interest rates low in 1972, despite rising inflationary pressures, in an attempt to ensure Nixon’s reelection — and thereby helping to set the stage for stagflation. One cardinal rule for every Fed chair since then has been, “Don’t be Arthur Burns.”

A tariff-fueled surge in inflation, then, is about as sure a thing as we ever get in economics. But after that, things get a lot less certain.

First, will the price shock from tariffs be a one-time event, or will it feed through into a sustained rise in the inflation rate? The Fed learned long ago to “look through” bumps in the inflation rate caused by fluctuations in volatile prices like the price of oil. That’s why it bases its interest policy on “core” inflation that excludes food and energy — not because food and energy prices don’t matter, but because excluding them gives a better measure of underlying inflation.

But how should we think about the tariffs? Are they a passing event like the now-forgotten oil price surge of 2007-8, or the potential beginning of 70s-type stagflation? I don’t know, and neither does Jay Powell. History offers no guidance: The Trump tariffs are the biggest trade policy shock in history.

Given this fog of inflation Powell is, and should be, cautious. He doesn’t want to be Arthur Burns.

But wait, there’s more. How will the tariffs affect the other side of the Fed’s mandate? Will the tariffs, and especially uncertainty about where they’re going, cause an economic slowdown and rising unemployment? Many observers believe that this will happen, and if it does it would indeed be a reason to cut interest rates. But again, nobody knows, since we’ve never before had a president who keeps announcing huge changes in tariffs every few weeks.

So what would you do if you were Jerome Powell? Almost surely what he is actually doing: Wait and see.

And Trump’s childish insults aren’t going to make any difference, except possibly to make Powell even more cautious to avoid giving the impression that he can be bullied.

MUSICAL CODA

Nobody in other countries is going to put up with his tantrum. We are rapidly becoming an international pariah. The days when people came from afar to vacation and study here are evaporating. We won't be an important market anymore because no business can plan with a madman in the WH. It is becoming unsafe for our own citizens... in 6 months, he is slaughtering the goose that laid the golden egg.

My only hope for the future is that Trump dies in prison, penniless.