Masayoshi Son and the Art of the Fake Deal

The investment Trump is touting is fake on multiple levels

Just a quick note about the latest fake news, economic policy edition. (I have a doctor’s appointment, and probably won’t get my planned post, about health care, out until the middle of the day.)

You may have seen that Trump has made a big deal of an announcement by Masayoshi Son that he plans to invest $100 billion in the United States, supposedly creating 100,000 jobs. Big deal, no?

No.

First, as news reports mostly seem to acknowledge, this appears to involve investments Son was already planning to make before the election, which he and Trump are now presenting as a response to Trump. The same thing happened in 2016.

Second, that last round of investments turned out miserably. A lot of it went to WeWork. Remember them? Nobody can be sure how many people ended up with new jobs thanks to Son’s money last time, but it probably wasn’t many.

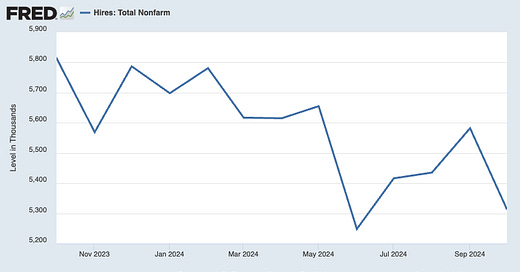

Third, announcements like this depend a lot on assuming that both the public and the media are innumerate. “One hundred thousand jobs.” (Already used a picture of Dr. Evil yesterday, so I don’t do it again.) That may sound impressive if you have no idea how big the U.S. economy is, and how much labor market churn takes place on a normal basis. But more than 5 million Americans are hired every month:

Even if Son really does create employment, which is doubtful, it will be invisible in the data and have no perceptible effect on the ease with which workers can find jobs.

But finally, we’re now seeing a perfect example of the arithmetic problem I pointed out the other day. Trump wants to reduce the U.S. trade deficit; he also wants to attract more foreign investment into the United States. But he can’t, as a matter of sheer accounting (which, I know, has a well-known globalist/Marxist bias):

Trade balance + Net inflows of capital = 0

If more money flows into America, that must mean a bigger, not smaller trade deficit. Son is probably offering a Potemkin investment rather than something real. But if it were real, it would drive up the dollar, making U.S. goods less competitive on world markets.

Again, this particular investment announcement is probably a sham. But it is possible that perceptions that Trump is good for business will, for a while, draw in foreign money and strengthen the dollar. Trump won’t like that, and he’ll lean on the Federal Reserve to do something, like cut interest rates.

Which brings me to my final thought: I don’t think markets are properly pricing in the likely inflationary consequences of Trump’s coming war on arithmetic.

Thanks for coming to Substack and leaving the Times!

Let’s not also forget about the Foxconn factory in WI that was never built