The macro equivalent of war?

More thoughts on the Democratic unstimulus

This ain’t no party, this ain’t no disco

History is the great laboratory of economics, certainly of macroeconomics. I love to talk about miniature economies that illustrate macroeconomic principles, like baby-sitting coops, but by and large the only place we can test theories about how the economy works is on the economy itself. And nobody is willing to try out potentially disastrous policies just to see how they work in practice.

So we turn to historical examples that, we hope, provide natural experiments. The problem, however, is how to select these examples — and in particular how to avoid selecting examples that aren’t especially relevant but that confirm your prejudices. Germans, for example, are taught endlessly about the 1923 hyperinflation, but generally know little about the Brüning deflation of 1930-31, which was what actually brought [Godwin’s Law violation] to power. After 2010 I used to protest about the Hellenization of economic discourse — the way the woes of Greece, which was very much sui generis, became Exhibit A for everyone who, for whatever reason, wanted us to panic about debt and deficits.

And one enduring source of bad economic discussion has been the tyranny of disco-era economics — the weird grip the stagflation of the 1970s still has on economic discourse, even though real incomes suffered more in later crises, from the Volcker recession of the early 80s to the 2008 financial crisis to, of course, the pandemic than they ever did in the 70s:

Now, as the Biden economic relief bill marches toward passage, we’re hearing a lot from talking heads (as opposed to the Talking Heads) about the return of stagflation — mainly, but not only, the same talking heads who predicted stagflation from Obama’s policies. And let’s be clear: while the American Rescue Plan is mainly disaster relief rather than conventional stimulus, it’s a big proposal that will, in fact, provide a lot of economic stimulus, and could well have some temporary inflation impact.

But the ARP isn’t at all like the events that (we think) brought on the 1970s — a long period of economic overheating followed by the two oil shocks. What does it resemble?

In macroeconomic terms, I’d argue, it looks like a medium-sized war. And the historical experience of such wars is probably our best guide to the macroeconomics of the current plan.

I’m not the only person to make this comparison. Joe Gagnon at PIIE argues that we should think of this plan as being something like the Korean War — a temporary shock that was pretty big but not sustained, as opposed to the long guns-and-butter stimulus of Vietnam. I agree, but think it’s useful to look at a wider set of examples.

A brief history of wartime inflations

The Congressional Research Service has compiled estimates of military spending on wars throughout U.S. history, and in particular peak spending as a percentage of GDP. Here’s a partial view, with the current estimated size of the ARP (8.6% of GDP) included:

Note that I don’t include World War II, which was vastly bigger but also took place in the context of a controlled economy, with pervasive rationing and price controls. I also omit Vietnam, which was modest as an annual expense but went on and on — long enough that as a college student, class of 1974, I received a draft lottery number (although my year never did get called.)

I do include Iraq, but only to highlight the fact that it was, in dollar terms, a small war, however significant it was politically (and however many people died.)

Other than that, the Biden plan is in the same general range as a number of wars: the Civil War (from the Union side), World War I, and Korea.

Now, there are some reasons to believe that the Biden plan will lead to less overheating than these wartime episodes. For one thing, some estimates — like these from Goldman Sachs — suggest that we’re starting from an economy operating well below potential, so that much of whatever expansion takes place will simply fill an output gap:

Also, unlike military expenditures, many (most) of the outlays under the ARP will take the form of transfer payments rather than purchases of goods and services; since some of these transfers will be saved, the overall multiplier will probably be relatively low.

Still, we may be able to learn something from these wartime episodes. And what we see in each case is a bump in prices, but not a sustained rise in inflation.

Here’s what happened during and after the Civil War (again, on the Union side; the Confederacy experienced hyperinflation):

There was a big runup in prices, but it didn’t translate into permanent inflation; in fact, it was followed by deflation, as advocates of monetary orthodoxy did their best to crucify the country on a cross of gold.

World War I was a seemingly endless conflict for the European powers, but it was a relatively brief if intense effort for the United States. My numbers, drawn from Historical Statistics of the United States, look a bit different from the CRS estimate, but not in any important way; here’s what the war looked like compared with the current relief package:

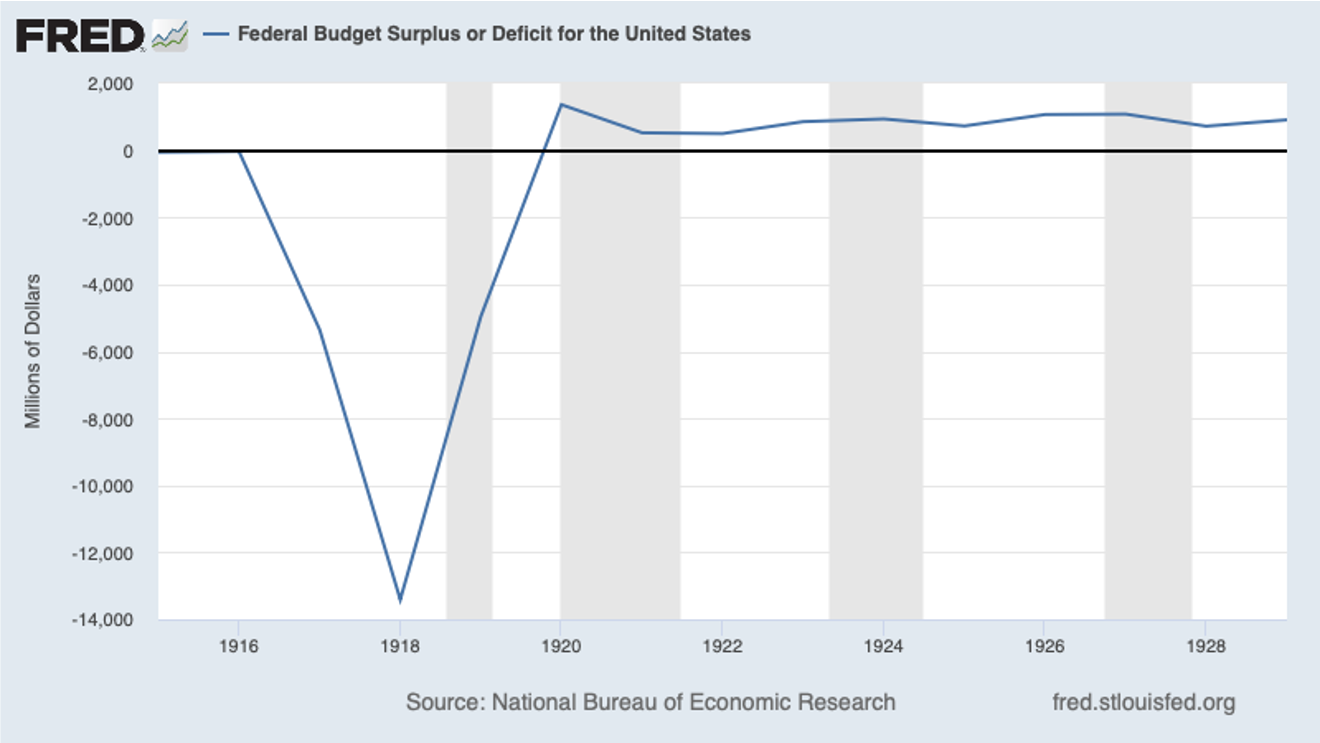

In case you’re wondering, the war was overwhelmingly debt-financed:

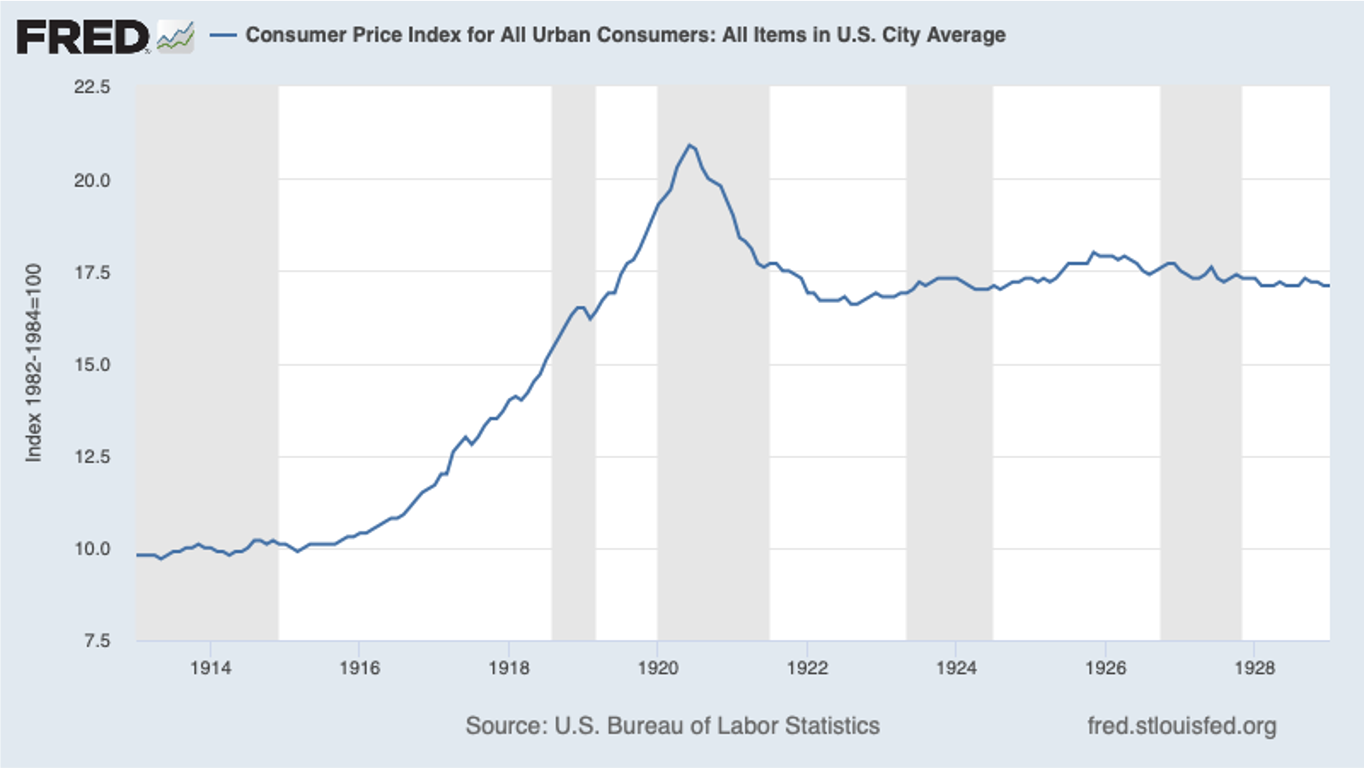

And what happened to prices looked a lot like the Civil War — even the magnitudes were similar, with a rough doubling of prices during the war but no sustained rise in inflation:

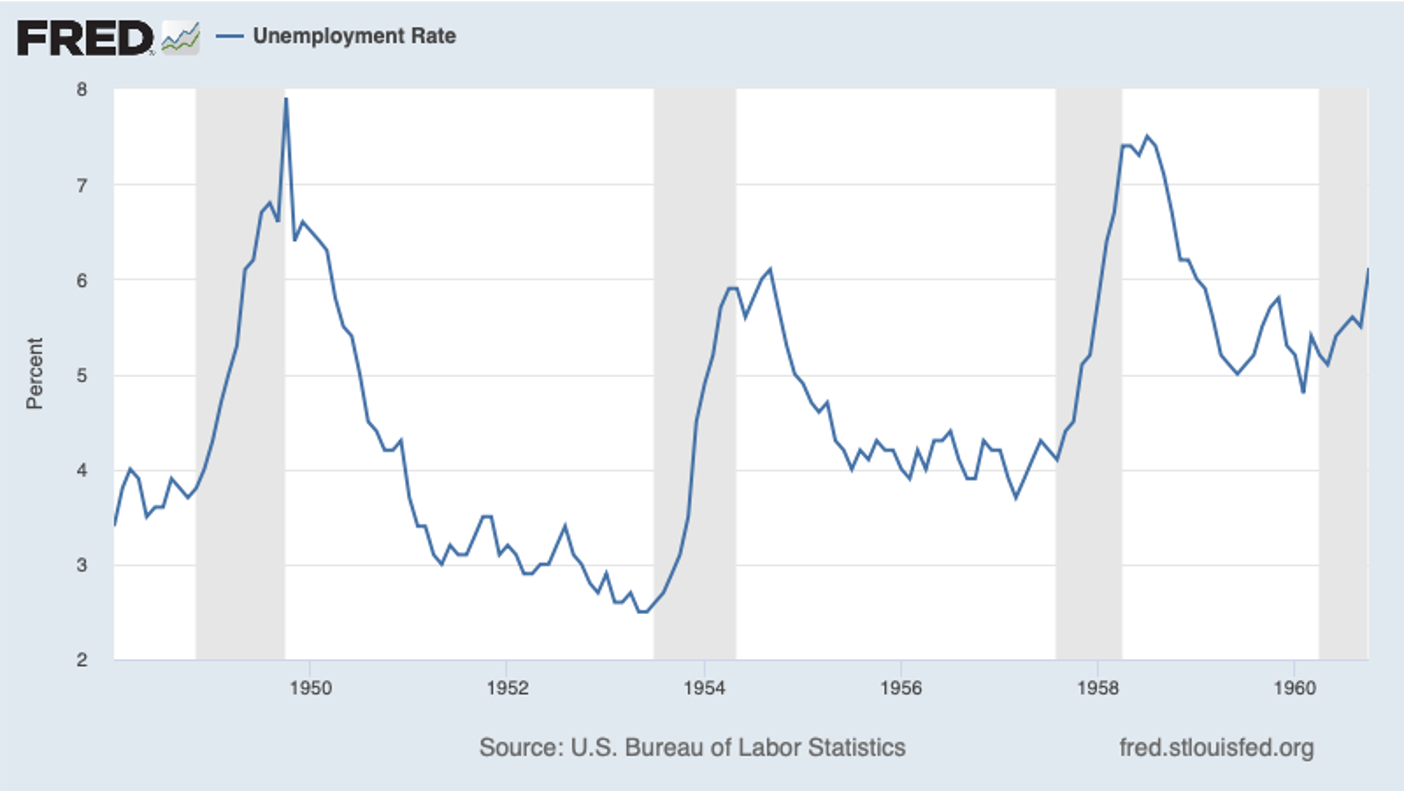

Finally, Korea looks somewhat different. For one thing, while the war was temporary, it marked the beginning of a sustained period of high military spending with the realization that the Cold War wasn’t going away:

In part because of this realization, much more of the military buildup was paid for with taxes than in previous episodes. Nonetheless, the war was clearly expansionary:

Actually, Korea may be one of the best real-world illustrations of the balanced-budget multiplier: even when increased government spending is paid for with taxes, some of the tax hike comes out of savings, so the net effect is still expansionary.

On prices, I slip a derivative here, because I believe that prices were a lot stickier in the 1950s than in the earlier episodes, and Korea was never followed by actual deflation. Nonetheless, what we see is a temporary bulge in inflation, not a sustained rise:

So while there are risks to a big economic relief package, the risk of replaying the 1970s isn’t one of them. Democrats may say to themselves, how did we get here? They may ask themselves, my God, what have we done? But it’s not going to be 1979 redux.

Very interesting! However, I would like to see more posts about buildings and food.

In February 2024, the New York Times columnist Paul Krugman lamented how “the hand-wringing over Biden’s age has overshadowed the real stakes in the 2024 election.”

Paul Krugman reassured readers, “As anyone who has recently spent time with Biden (and I have) can tell you, he is in full possession of his faculties—completely lucid and with excellent grasp of detail.”