Source: Google.

Herbert Hoover, move over.

The 31st president has long been the patron saint of bad economic management. But while Hoover responded badly to the coming of the Great Depression, he didn’t cause the slump. By contrast, it seems more and more likely that Donald Trump will single-handedly push the solid economy he inherited into crisis. This is, as Trump might say, disastrous policy like nobody has seen before.

How is he managing that feat? While the vast majority of economists think high tariffs are bad policy, they don’t normally associate them with recession. Many, perhaps most economists who’ve looked hard at the evidence don’t accept the popular story that the Smoot-Hawley tariff of 1930 caused the Great Depression.

But this time looks and feels different. Why is a Trump Slump brought on by tariffs looking more probable by the day?

Like many others, I’ve been talking a lot about the huge uncertainty Trump is creating. Ignore the desperate efforts to retcon Trump’s trade policy, to pretend that it comes out of some coherent economic doctrine. We’re clearly looking at tariffs driven by id, not ideology — Trump’s biggest motivation seems to be the desire to see other countries grovel. Because there’s no clear policy objective, nobody knows what Trump will do tomorrow, let alone over the next few years. Did you have 104 percent tariffs on China and 34 percent tariffs on Canadian softwood lumber on your dance card? (Are 2x4s the industry of the future?)

As I wrote a few days ago,

Permanent tariffs are bad for the economy, but businesses can, for the most part, find a way to live with them. What business can’t deal with is a regime under which trade policy reflects the whims of a mad king, where nobody knows what tariffs will be next week, let alone over the next five years. Are these tariffs going to be permanent? Are they a negotiating ploy? The administration can’t even get its talking points straight, with top officials saying that tariffs aren’t up for negotiation only to be undercut by Trump a few hours later.

Under these conditions, how is a business supposed to make investments, or any kind of long-term commitment? Everyone is going to sit on their hands, waiting for clarity that may never come.

But wait, there’s more. There are growing signs that we’re at risk of a tariff-induced financial crisis.

There are multiple indicators of that risk. Bear with me while I give a somewhat wonkish explanation of one indicator that really caught my eye.

Back in the good old days, that is, two weeks ago, the main concern about Trump’s tariffs was that they would cause sustained inflation. We knew that they would produce at least a temporary bump in consumer prices, but the big question — crucial for Federal Reserve policy — was whether this bump would lead to a sustained rise in expected inflation, and become entrenched in the economy.

That’s what happened in the 1970s and is the reason getting inflation down in the 1980s required years of high unemployment. It didn’t happen during the Biden years, which is why this time we were able to get inflation way down without a recession.

So everyone has been watching measures of expected inflation for clues. And the news from consumer surveys has been very worrying. Here’s long-term expected inflation from the widely cited Michigan Consumer Surveys:

Source: University of Michigan

Whoa. But consumers don’t set prices. Furthermore, the last few years have shown that what consumers say they believe about the economy isn’t a good predictor of their behavior. So you’d want some confirmation from other measures.

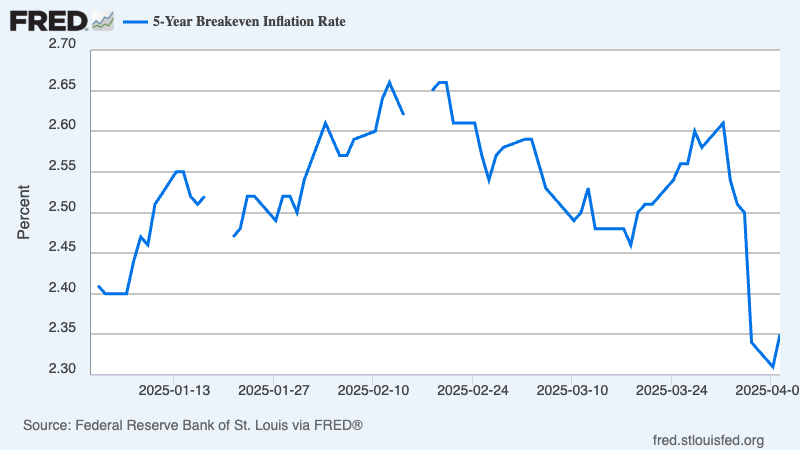

Late last month Austan Goolsbee, president of the Chicago Fed, said that it would be a “major red flag of concern” if market-based measures of expected inflation rose. He mainly meant “breakeven” rates, the spread between interest rates on bonds that are indexed to consumer prices and bonds that aren’t. That spread can normally be seen as an implicit prediction of how much consumer prices will rise.

So here’s the 5-year breakeven rate this year:

Wait, what? Has expected inflation actually fallen as Trump’s tariff plans have proved far more aggressive than anyone expected?

No, that’s not what’s happening. What we’re actually seeing is investors, especially hedge funds, selling assets in a “dash for cash.” When investors sell off bonds, they drive their price down, which means that they push their yield up. Why does this cause the breakeven rate to fall? Because the market for indexed bonds is relatively small and thin, so the rush to sell has a bigger effect in depressing prices and raising interest rates for index bonds than for ordinary bonds.

This isn’t the first time this has happened. Look at the breakeven rate over the long term: It plunged during the 2008-9 financial crisis and again when Covid hit:

Investors weren’t really predicting huge deflation in 2008-9, they were just rushing to sell assets and raise cash. And that’s what’s happening now, although not to the same degree (yet).

In other words, I was looking for guidance about inflation and instead found the telltale signs of an incipient financial crisis. Others, looking at other indicators, from the basis trade to junk bonds to struggles to refinance private loans, are seeing the same thing.

Why is this happening? Trump’s erratic policies have increased the risk of recession, but besides that their sheer extremism — from almost-free trade to tariffs higher than Smoot-Hawley in less than three months — has hurt some borrowers much more than others. Look at the chart at the top of this post. There’s a reason Elon Musk is lashing out at Peter Navarro, Trump’s tariff guru, calling him “Peter Retarrdo” and declaring that he is a “moron” and “dumber than a sack of bricks.”

Aren’t you glad that grownups are in charge?

And here’s the thing: Lenders will be hurt if some borrowers are forced into default, even if others are doing well, because lenders don’t share in the upside. So even though stock prices are dominating the headlines, the real, scary action is in the bond market. The nightmare scenario, which we saw play out in 2008, is that falling asset prices cause a scramble for cash, which leads to fire sales that drive prices even lower, and the whole system implodes. Suddenly, that scenario doesn’t look impossible.

Maybe we’ll steer away from the edge of the abyss. But Trumponomics has already proved worse than even its harshest critics imagined, and the worst may be yet to come.

MUSICAL CODA

Came across this essay by a 16th century philosopher, LaBoetie, whose writing seems so relevant to the crisis we are facing today. How I wish all leaders in all industries, nationally and internationally, heeded his advice: "We simply will give the tyrant nothing"!

Discourse on Voluntary Servitude:

Why People Enslave Themselves to Authority

By E. LaBoetie (Philosopher and Writer, 1530-1563)

(A 3-part essay. Excerpts with some adaptation for readability)

“How does it happen that an entire nation suffers under a single tyrant?

People suffer plundering, wantonness, cruelty on account of a single little man. Too frequently this same little man is the most cowardly in the nation, a stranger to the powder of battle and hesitant on the sands of the tournament, and with hardly enough virility to bed with a common woman. Who could really believe that one man alone may mistreat millions and deprive them of their liberty?

The answer? We let ourselves be deprived before our own eyes of the best part of our liberties. This misfortune, this ruin descends upon us not from alien foes but from the one enemy whom we ourselves render as powerful as he is.

The more a tyrant pillages, the more he craves, the more he ruins and destroys. And the more we yield to him and obey him, the mightier and more formidable he becomes, the readier he is to annihilate and destroy us.

But if not one thing is yielded to him, if without any violence he is simply not obeyed, he becomes naked and undone and nothing, just as when the root receives no nourishment, the branch withers and dies.

He has indeed nothing more than the power that we confer upon him to destroy us.

He does not have any power over us except through us.

Let’s not grow accustomed to the idea of subjection.

Let’s not lose warlike courage, all signs of enthusiasm because our hearts are degraded, submissive, and incapable of any great deed. A tyrant is well aware of this, and in order to degrade his subjects further, he will do what he can for us to assume this attitude and make instinctive.

The tyrant may reduce our freedom of action, of speech, and almost of thought, but in spite of this we will stand together in our aspiration. Our love for liberty and valor will not perish.

The desire for True Liberty must give us new strength. Not the notion of ‘liberty’ that is used to cover a false enterprise.

If things are to change, we must also realize the extent to which the foundation of tyranny lies in the vast networks of corrupted people with an interest in maintaining tyranny.

Such men must not only obey orders, they must anticipate his wishes, to satisfy him they must foresee his desires; they must wear themselves out, torment themselves, kill themselves with work in his interest, and accept his pleasure as their own, neglecting their preference for his, distorting their character and corrupting their nature; they must pay heed to his words, to his intonation, to his gestures, and to his glance. Can this be called a happy life? Can it be called living? Is there anything more intolerable than that situation … for anyone having the face of a man?

Still, men accept servility in order to acquire wealth and personal power.

The fact is that the tyrant is never truly loved, nor does he love.

There can be no friendship where there is cruelty, where there is disloyalty, where there is injustice. And in places where the wicked gather there is conspiracy only, not companionship. They have no affection for one another. Fear holds them together. They are not friends, they are merely accomplices.

We simply will give the tyrant nothing.

We will not weaken ourselves in order to make him the stronger and the mightier to hold us in check.

We are resolved to serve him no more and aim to regain your freedom.

We will simply no longer support him.

Like the great Colossus whose pedestal has been pulled away, he will fall of this own weight and break into pieces.”

Beyond the tariffs there are also all the other rash and erratic actions like laying of thousands of highly skilled senior staff and eliminating what have been relatively stable funding sources to states and other countries. It isn’t just the tariffs.