Springtime for Scammers

Financial predation now has friends in high places

Just over two years ago Wells Fargo agreed to pay $3.7 billion — $1.7 billion in penalties and $2 billion in damages — to the Consumer Financial Protection Bureau. As the New York Times report put it, the payments were

to settle claims that it engaged in an array of banking violations over the last decade that harmed millions of consumers

The Times went on to explain:

The consumer protection bureau said Wells Fargo did not record customer payments on home and auto loans properly, wrongfully repossessed some borrowers’ cars and homes and charged overdraft fees even when customers had enough money to cover purchases they made with their bank cards.

This settlement followed earlier scandals at Wells Fargo, notably the “cross-selling scandal” in which, among other things, bank employees opened as many as 2 million accounts in customers’ names without their authorization. Altogether the bank has paid $6.2 billion in penalties since 2016.

Overall, according to Sen. Elizabeth Warren, who conceived of CFPB, the bureau “has returned over $21 billion to families cheated by Wall Street.”

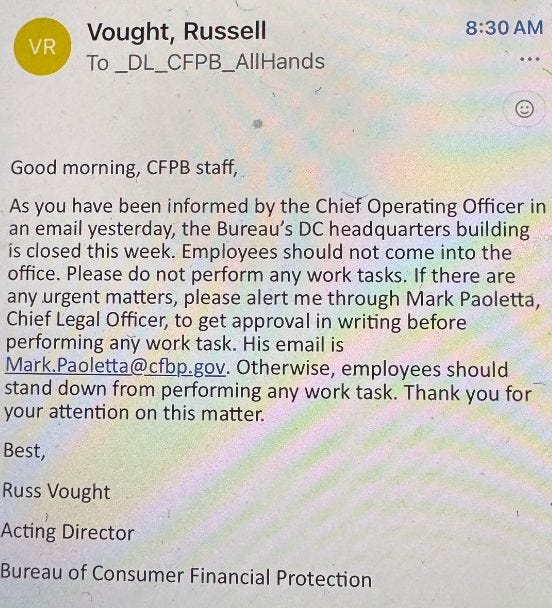

But now the agency that won those settlements has been effectively abolished. On Monday Russell Vought, the architect of Project 2025, the new director of the Office of Management and Budget and now CFPB’s acting head, sent the email above to all of the agency’s staff telling them to stay away from the office and do no work.

What’s this about? Let’s start by asking why CFPB was created.

The truth is that defending oneself against financial fraud is hard work. Do you carefully go through your bank statement every month, looking for possible unjustified fees? I know a few people who do, but most of us have too much else going on in our lives. When you take out a car loan, or invest for your retirement, do you go over the fine print with a magnifying glass, making sure you understand everything? Probably not. People have children to raise, jobs to do, lives to live. Cognitive overload is a real thing, and it’s worse the further down the income scale you go — the cognitive burden of poverty has been extensively documented.

So what we do, most of the time, is trust financial institutions to be relatively honest, if only to protect their reputations. And we expect government regulators to step in when financial players abuse that trust.

What we learned in the aftermath of the 2008 financial crisis was that much of this trust had been misplaced. Corporate cultures in the financial industry came to prioritize short-run profits over long-term reputation. Deregulation and lax regulation permitted widespread abuses. Most notably, the boom in subprime lending led to many families being sold financial products they didn’t understand, with lower-income borrowers receiving the worst treatment. As the late Edward Gramlich, a Federal Reserve official who tried in vain to warn his colleagues about the dangers, wrote:

Why are the most risky loan products sold to the least sophisticated borrowers? The question answers itself — the least sophisticated borrowers are probably duped into taking these products.

But why create a new agency to limit these abuses? Don’t we already have bank regulators? Yes, but these regulators are primarily focused on securing the stability of the financial system. Protecting consumers from fraud is at best an afterthought.

Warren’s insight was that protecting consumers required creating a separate agency with its own institutional imperatives. And she was right: By any reasonable standard, CFPB has been an outstanding success story.

Why, then, rush to shutter the agency? By the way, this action, like much of what the Trump administration is doing, is almost surely illegal. It probably also won’t surprise you to learn that DOGE appears to have illegally been given access to much of the agency’s data.

Well, it’s illuminating to read the section on abolishing CFPB in Project 2025’s Mandate for Leadership. According to the Mandate,

the agency has been assailed by critics as a shakedown mechanism to provide unaccountable funding to leftist nonprofits

Notice the careful wording: The document doesn’t assert that CFPB actually is a “shakedown mechanism” (which might have led to a lawsuit) but merely that “critics” have made that accusation. And if you follow the footnotes, the assault by critics appears to consist solely of three opinion pieces, one in the New York Post, one in the Wall Street Journal and one in Investors’ Business Daily.

Incidentally, that Investors’ Business Daily article accuses CFPB of funneling money to “radical Acorn-style pressure groups.” Does anyone not deeply mired in the fever swamps of right-wing conspiracy theory even remember what Acorn — a political association that was disbanded in 2010 — was?

Overall, Project 2025’s attack on the CFPB bears a family resemblance to Elon Musk’s claim that USAID is a “viper’s nest of radical-left Marxists who hate America.” It’s a bit milder, but equally absurd, and is clearly not the real reason for killing the agency.

So what is the real reason? It seems fairly obvious. CFPB was created to protect Americans from financial predation, and has done a very good job of doing so. But now we have government of, by and for financial predators. Trump has famously left behind a trail of bankruptcies and unpaid contractors, and is furiously grifting even now. Musk has faced multiple lawsuits from vendors and former employees over unpaid debts.

And let’s not forget that crypto, which has gained a lot of influence with this administration, has yet to find a real-world use case other than money laundering.

So the best way to explain the sudden closure of the Consumer Financial Protection Bureau, as I see it, is as part of an effort to make predatory finance great again.

MUSICAL CODA

The issue of trust will be recurring as the dismantling of democratic structures continues. We are all realising that trust is the glue that holds democracy together. And the process of destroying democratic institutions will damage or destroy whatever trust remains, including confidence that trust, consensus and agreement are credible foundations for government in general.

This is not going to end well for Trump and his ilk. Unfortunately we have to suffer the consequences of this criminal administration. It's all about the money. Trump is a dangerous figurehead for this group trying to destroy the government along with our standing in the world. Thanks to the Supreme Court Trump, already a lawless president, is out of control.