Is There an Insanity Premium on Interest Rates?

Something strange is happening in the bond market. Is it Trump?

The Federal Reserve responded to the inflation spurt of 2021-22 by sharply raising interest rates. It kept rates high for a long time, even though inflation was already most of the way back to the Fed’s (arbitrary) target of 2 percent by late 2023. But the Fed finally began cutting rates this past September. So are you feeling any relief?

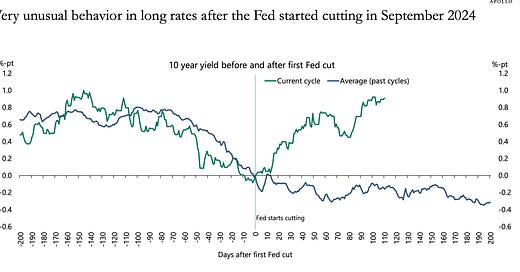

Probably not. The Fed only controls short-term rates — in fact its target, the Federal funds rate, is an overnight rate on loans between banks. Yet the interest rates that matter for peoples’ lives are longer-term: rates on 5-year car loans, 10-year corporate bonds, 15- or 30-year mortgages. And a funny thing has happened to those longer rates: they’ve gone up. Since the Fed began cutting, the benchmark 10-year Federal bond rate has risen by roughly the same amount the Fed funds rate has gone down.

This divergence is unprecedented. As Apollo’s Torsten Slok pointed out in a note Tuesday, long rates normally fall at least somewhat when the Fed is cutting:

So what we’re seeing now is very peculiar. Saith Slok:

The market is telling us something, and it is very important for investors to have a view on why long rates are going up when the Fed is cutting.

Well, I think there are three main views one might have here:

1. Markets, shmarkets.

2. Squeezing out that last bit of inflation is hard.

3. The bond market starting to suspect that Trump really is who he seems to be.

I’m going to make the case for #3, although I’m aware that this may be wishful thinking.

There’s nothing inherently paradoxical about short-term rates and long-term rates being different, or even moving in opposite directions. An investor choosing between a short-term and a long-term investment is always making a bet on future interest rates. For example, at the end of 2024 1-year CDs paid an average of 1.76% while 3-year CDs paid 1.43%. Did this make 1-years a better buy? Not if you expected rates to fall in the future, so that you should lock in that 1.43% while you could.

So if long rates were rising even as the Fed was cutting, it could be because investors are revising their estimates of future Fed rates upward. But why would they do that?

You shouldn’t assume that the markets are right, certainly not that they know anything the rest of us don’t. John Maynard Keynes had some strong, elegantly expressed views about the “precariousness” of market pricing and how it neglects the long term. Much of what he said applies better to stock than to bond markets, which tend to be much more sober. But bond investors are betting on future macroeconomic developments, and they’re basically working off the same information as every economist who knows how to use FRED.

Still, I hear a lot of chatter to the effect that although disinflation has proved immensely easier than many economists predicted — let’s not memory-hole those claims that containing inflation would require five years of 6 percent unemployment — inflation may be stalling out between 2.5 and 3 percent, rather than falling all the way back to 2. Is this true?

Well, I’ve spent a lot of time reading economists trying to parse the data to estimate underlying inflation; is it 2.8? 2.4? 2.1? I’ve even done some of that myself. But at this point I feel that we’ve become haruspices looking for omens in the entrails of sacrificed goats.

For what it’s worth, businesses, who presumably are closer to the ground than the rest of us, don’t see disinflation stalling in the near term:

Which brings us to #3: increases in long-term rates, like the 10-year Treasury rate, might reflect the horrible, creeping suspicion that Donald Trump actually believes the crazy things he says about economic policy and will act on those beliefs.

Look at the dynamic over the past few days. Jeff Stein of the Washington Post reported that people around Trump were planning a fairly limited, strategic set of tariffs rather than the destructive trade war against everyone Trump has been promising; Trump quickly responded with a Truth Social post calling the report “Fake News” and declaring that he does too intend to impose high tariffs on everyone and everything.

In short, Sources: “Trump isn’t as crazy as he looks.” Trump: “Yes I am!”

Then, as if to dispel any lingering suspicions that he might be saner than he appears, Trump held a press conference in which he appeared to call for annexing Canada, possibly invading Greenland, seizing the Panama Canal and renaming the Gulf of Mexico the Gulf of America. This morning CNN reported that Trump is considering declaring a national economic emergency — in a nation with low unemployment and inflation! — to justify a huge rise in tariffs.

What does this have to do with interest rates? There’s near-unanimity among economists that Trump’s announced agenda of high tariffs, tax cuts and mass deportations would be highly inflationary, although probably not right away; whatever Trump does, inflation will probably remain low for much of this year. Still, if he were to go through with any substantial part of that agenda, the Fed would definitely have to put further interest rate cuts on hold. In fact, it might well feel the need to raise rates again.

True, Trump — who declared yesterday that rates are still too high — would fly into a rage if the Fed were to raise rates. In fact, he might well demand that the Fed continue cutting rates. And given the way almost every prominent American institution has been prostrating itself, are we sure — really, really sure — that the Fed would be able to maintain its independence? Can we envision Fed officials hiding in their offices as a MAGA mob storms the Eccles Building? Actually, yes.

But if the Fed does let itself be pressured, that would eventually mean higher, not lower rates. Many economics students learn about how Richard Nixon pressured the Fed to keep rates low before the 1972 election, despite growing inflation concerns. The end result was to help send inflation and interest rates soaring.

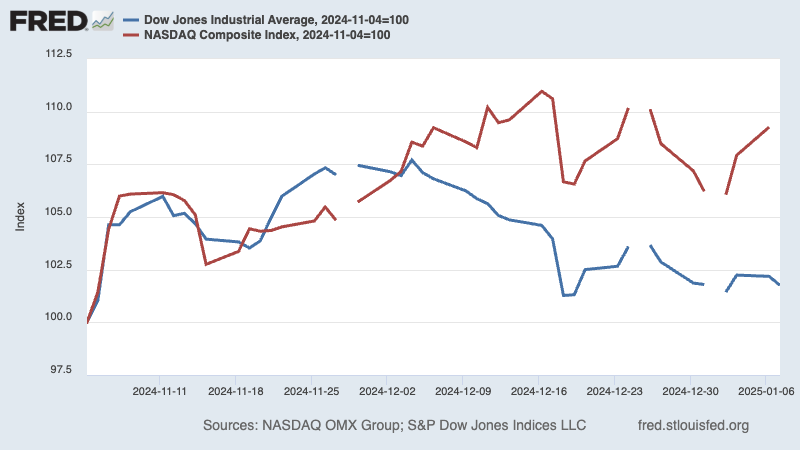

But, you may ask, if bond investors are starting to worry about the madness of Trump 2.0, why are stocks up?

I’d offer two possible answers. One is that stock and bond investors are different; the former are a lot more limbic, i.e., lizard-brained. Everyone knows about meme stocks, which soar because of frenzies on social media. I haven’t heard of any meme bonds.

The other is that the recent rise in stocks is rather narrow. Arguably, it’s mainly about AI. The Dow, which can be seen as a proxy for the non-AI economy, has already given up almost all of the Trump bump:

OK, I don’t want to push this too far, in part because I don’t want to give in to motivated reasoning. Those of us horrified by Trump’s ascent would like to see him punished by the markets, but we shouldn’t expect instant gratification. It may well be years before the consequences of his economic delusions are really obvious.

But rising interest rates even as the Fed cuts may be an early sign of things to come.

MUSICAL CODA

A definite lack of good songs about the term structure of interest rates. But in honor of Trump’s press conference:

There is a general insanity premium. Not sure how you make this dense stuff so readable but I'm glad you do. Also glad that you no longer have to satisfy the minders at the NYT and are able to let loose. The world is better for it.

Who knew I would be getting my morning music fix from Paul Krugman.