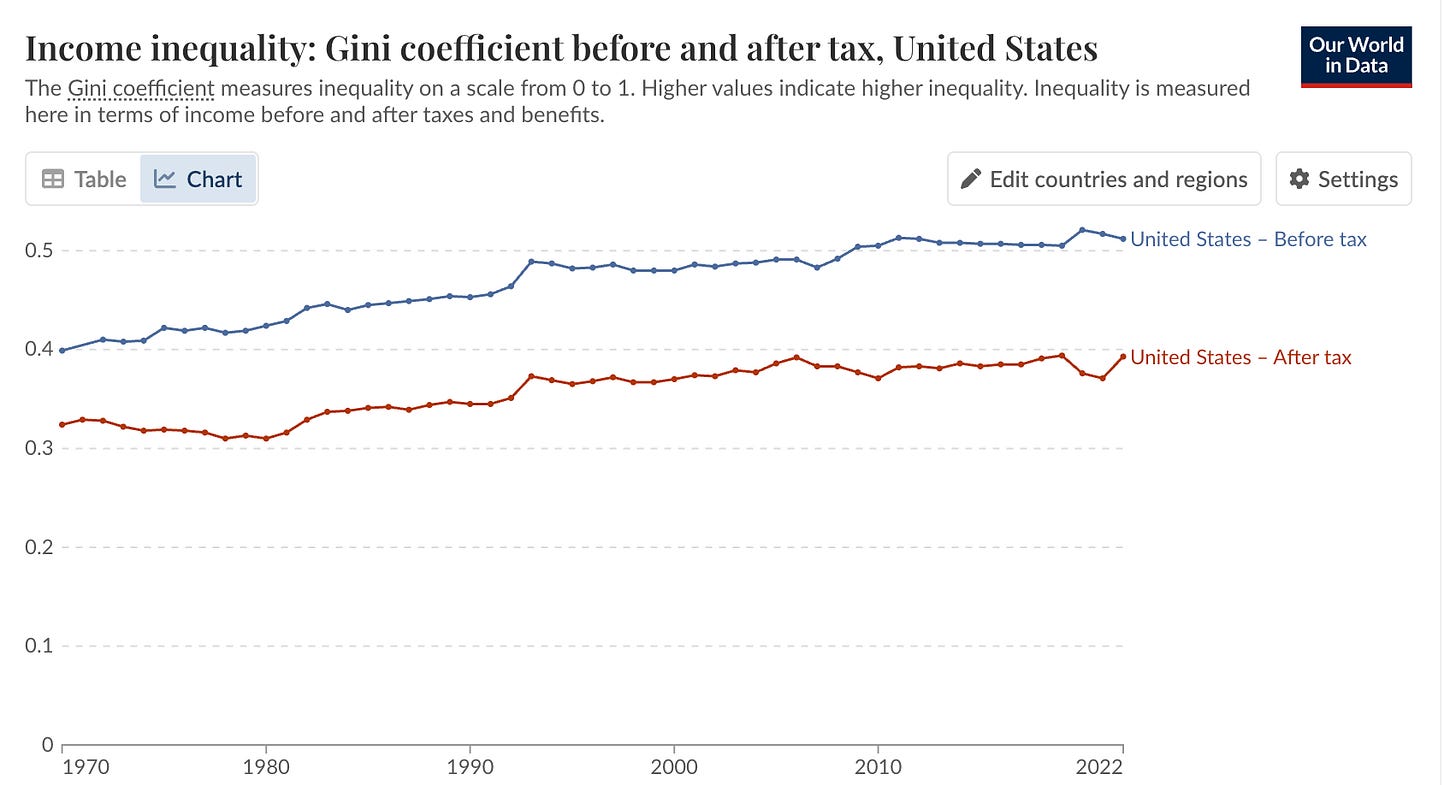

Market economies inevitably give rise to substantial inequality in income and wealth. Modern governments, however, have tools at their disposal, including but not limited to taxes and income transfers, that can mitigate inequality. In fact, all advanced-country governments do, in practice, redistribute income downward. As a result, post-tax-and-transfer inequality is lower than market inequality. As the chart at the top of this post shows, America’s Gini coefficient — a widely used measure of inequality — has consistently been lower for income after taxes and transfers than for pre-tax income.

Yet soaring U.S. inequality since 1980 hasn’t inspired a major government effort to counter that trend. In fact, policy changes, notably Republican tax cuts for the wealthy, have accelerated the growing disparities. And as I’ll explain later, the current level of inequality in America is much higher than what would be expected in a truly democratic polity, one in which all citizens had an equal voice.

Clearly, the economic elite possesses political power greatly disproportionate to its share of the electorate. Some readers are no doubt saying “Well, duh — everyone knows that.” Indeed we do.

Yet how, exactly, does this work? What mechanisms give the 1 percent and the 0.01 percent so much political power in the United States — especially compared with other countries? And why has their power increased in recent years?

I had planned to make this the last post in my inequality series. As it turns out, I’m going to need at least one more post to discuss recent extraordinary events involving financial and technology regulation. For now, however, let me focus on the general question of how wealth translates into power in a system that nominally gives every citizen an equal voice.

Beyond the paywall, I’ll discuss the following:

1. How we know that inequality in the United States is higher than it would be in a truly democratic polity

2. The role of campaign finance

3. Other forms of influence-buying

4. The pervasive gravitational pull of big money

Keep reading with a 7-day free trial

Subscribe to Paul Krugman to keep reading this post and get 7 days of free access to the full post archives.