Last week the House passed the GENIUS Act, which will boost the growth of stablecoins, thereby paving the way for future scams and financial crises. On Thursday the House also passed a bill that would bar the Federal Reserve from creating a central bank digital currency (CBDC), or even studying the idea.

Why are Republicans so terrified by the idea of a CBDC that they’re literally ordering the Fed to stop even thinking about it?

In 2022 the Fed issued a preliminary report on the possibility of creating a CBDC, which it described as “analogous to a digital form of paper money.” Currently, Americans are able to hold and spend one form of Federal Reserve liability: green pieces of paper bearing pictures of dead presidents. A CBDC would expand that right, allowing us to hold and spend deposits at the Fed, which, like all deposits these days, would just be digital records.

If this sounds outlandish, you should realize that we already have what amounts to central bank digital currency — but only for financial institutions. Banks maintain accounts at the Fed and can transfer funds to each other via an electronic payments system. Why shouldn’t comparable facilities be made available to individuals and nonfinancial companies?

Republicans say that they’re worried about invasion of privacy, that a CBDC would open the door to widespread government surveillance. But remember, these are the people who have handed over personal Medicaid data to ICE to facilitate arrests and abductions. If you think they’re deeply concerned about potential surveillance, I have some Trump family memecoins you might want to buy.

I’d also point out that the government can access private bank records under certain circumstances and certainly has the technological ability to watch every financial move you make. The only thing that keeps it from doing so is the law, specifically the Right to Financial Privacy Act. If we ever do create a CBDC, it will surely involve comparable privacy protection. Either you trust in rule of law or you don’t.

What Republicans are really afraid of, with good reason, is the likelihood that many people would prefer a CBDC to private bank accounts, especially but not only stablecoins. And in general any attempt to create a full-fledged CBDC would run into fierce opposition from the financial industry.

But what about the possibility of creating a partial CBDC? Could we retain private bank accounts but provide an efficient, publicly-run system for making payments out of those accounts?

Yes, we could. We know this because Brazil has already done it.

Most people probably don’t think of Brazil as a leader in financial innovation. But Brazil’s political economy is clearly very different from ours — for example, they actually put former presidents who try to overturn elections on trial. And the interest groups whose power, for now at least, makes a U.S. digital currency impossible appear to have much less sway there. Brazil is, in fact, planning to create a CBDC. As a first step, back in 2020 it introduced Pix, a digital payment system run by the central bank.

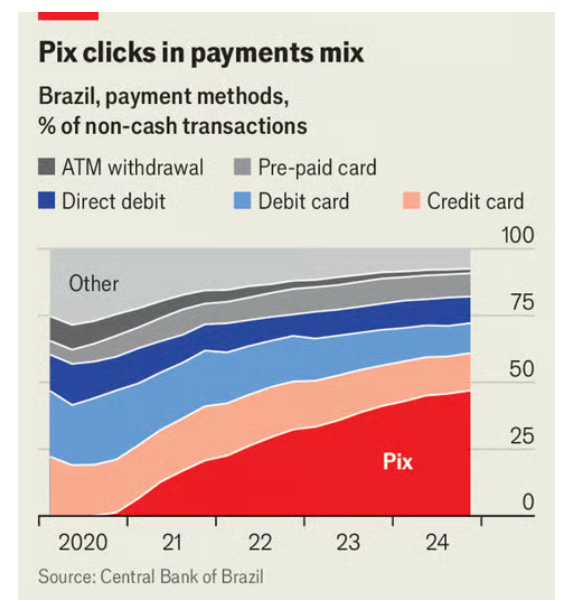

As I understand it, Pix is sort of like a publicly run version of Zelle, the payment system operated by a consortium of U.S. private banks. But Pix is much easier to use. And while Zelle is big, Pix has become simply huge, used by a reported 93 percent of Brazilian adults. It appears to be rapidly displacing both cash and cards:

Source: The Economist

And why not? According to an IMF report,

· Pix transactions take place almost instantaneously. A Pix payment settles in 3 seconds on average versus 2 days for debit cards and 28 days for credit cards.

and

· Transaction costs are low. The authorities have set a requirement on Pix to be free for individuals, and the cost of a payment transaction for firms/merchants is only 0.33 percent of the transaction amount, versus 1.13 percent for debit cards and 2.34 percent for credit cards.

I can’t help noticing that Pix is actually achieving what cryptocurrency boosters claimed, falsely, to be able to deliver through the blockchain — low transaction costs and financial inclusion. Compare the 93 percent of Brazilians using Pix to the 2 percent, that’s right, 2 percent of Americans who used cryptocurrency to buy something or make a payment in 2024.

Oh, and using Pix doesn’t create an incentive to kidnap people and torture them until they give up their crypto keys.

So, will we get a Pix-type system in the United States? No. Or at least not for a long time, for two reasons.

First, the U.S. financial industry just has too much power, and would never allow a public system to compete with its products — even, or actually especially, if the public system is superior. In fact, the Trump administration suggests that Pix’s mere existence in Brazil constitutes unfair competition for U.S. credit and debit card companies.

Second, the U.S. right is firmly committed to the view that the government is always the problem, never the solution. Republicans will never, ever admit that a government-operated payments system might be better than private-sector alternatives.

Other nations may well learn from Brazil’s success in developing a digital payment system. But America will probably remain trapped by a combination of vested interests and crypto fantasies.

MUSICAL CODA

I’m from Brazil and I study together with law professors at Federal University of Minas Gerais (UFMG) the Monetary System here and the role of Brazilian Central Bank. I did a research in 2023 regarding the CDBC (now called Drex), and the stage of development is really impressive. Pix is already a success as you mentioned, and Drex has been tested for the wholesale model. I’m very happy to see a Nobel laureate professor as you talking about that and recognizing the innovation in Brazil’s monetary system.

I knew ex GI’s from WWII who hated German products or who refused to buy Japanese cars well into the 1990s. In similar fashion, I will hate Republicans for the rest of my life.