Getting Ready to Party Like It’s 2008

Trump’s cronies are undermining financial stability

On Sept. 15, 2008 Lehman Brothers failed. Within weeks the whole U.S. financial system was caught in the downward spiral of a massive bank run, on a scale not seen since the 1930s. Yet there was an important difference from the 1930s bank runs: in 2008, the panic mainly resulted in flight from “shadow banks,” nonbank institutions that performed bank-like functions. Conventional banks were largely immune from the 2008 panic because deposit insurance and federal regulations – a consequence of the 1930s bank runs – protected them.

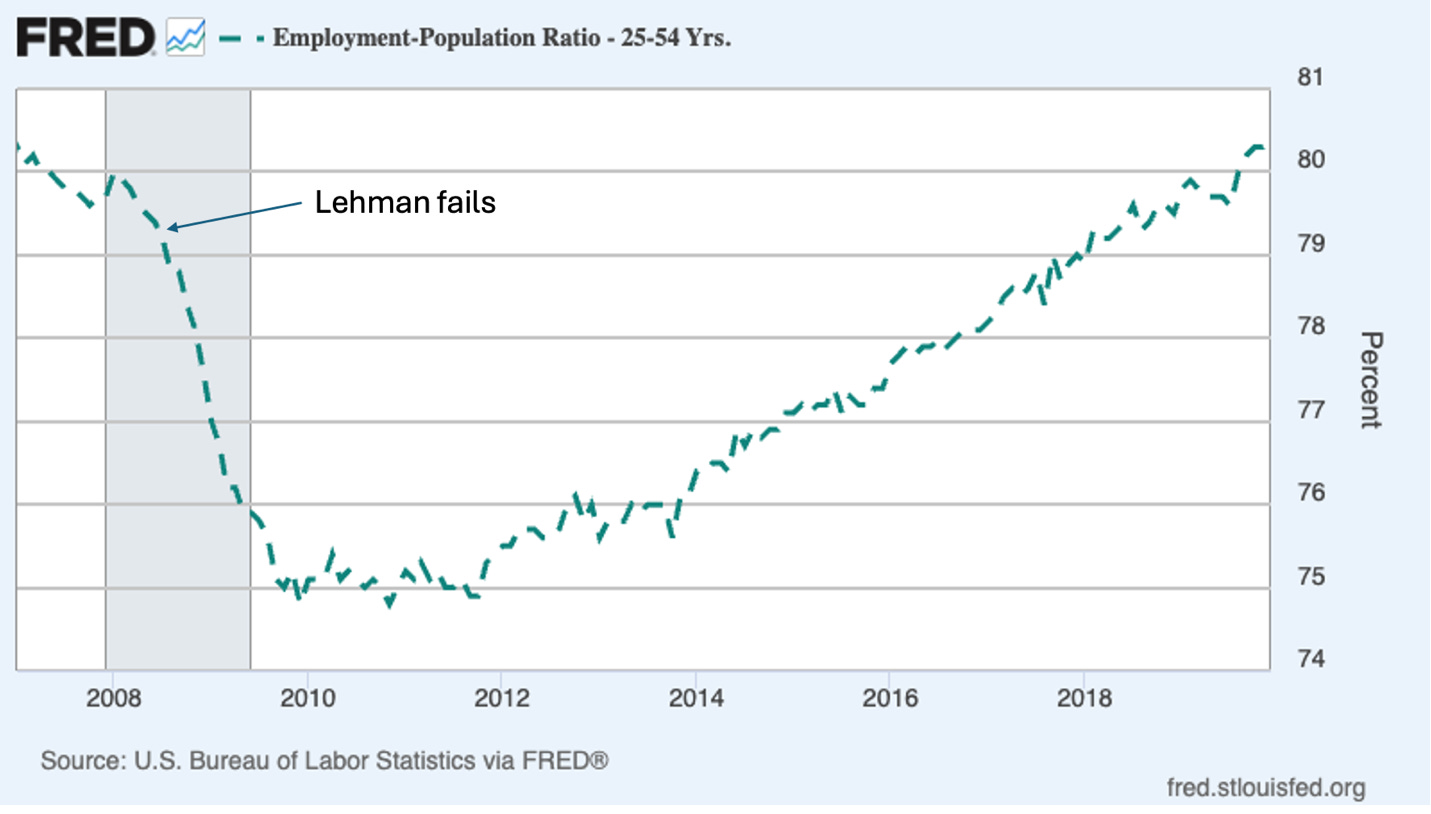

While the U.S. economy was already in recession when Lehman fell, the financial crisis pushed it off a cliff into a deep recession. Despite frantic efforts to stabilize the financial markets, including large bailouts and huge lending by the Federal Reserve, America lost 6 million jobs in the year following Lehman’s fall. Total employment didn’t return to pre-recession levels until 2014. The share of prime-working-age adults with jobs remained depressed until the late 2010s:

The clear lesson of 2008 is that effective financial regulation is essential. For three generations after the great bank runs of 1930-31, America avoided “systemic” banking crises — crises that threaten the whole financial system, as opposed to individual institutions. This era, which Yale’s Gary Gorton calls the Quiet Period, was the result of New-Deal-era protections — especially deposit insurance — and regulations that limited banks’ risk-taking.

But post 1980, finance was increasingly deregulated. In particular, the government failed to extend bank-type regulation to shadow banks that posed systemic bank-type risks. And the crisis came.

In a way, the laxity that made the 2008 crisis possible was understandable. By the 2000s nobody in government or the financial markets remembered what a real financial crisis was like. And no, watching “It’s a Wonderful Life” on Christmas Day doesn’t count.

But here we are in 2025, and 2008 wasn’t that long ago. Many of us still have vivid memories of the gut-wrenching panic that gripped the world when Lehman fell. Yet Donald Trump’s allies and cronies are now moving rapidly to dismantle the precautionary regulations introduced after 2008 to reduce the risk of future financial crises. I say “allies and cronies” advisedly. There’s no indication that Trump himself has any idea what’s happening on his watch. But key players in Congress, within the administration, and, alas, at the Federal Reserve, are apparently determined to make a 2008 rerun possible.

The MAGA war on financial stability is being waged largely on two fronts. First, there’s an ongoing effort within some parts of the Federal Reserve to drastically weaken bank supervision — oversight of banks to prevent them from taking risks that could threaten the financial system.

The Fed has multiple roles: in addition to setting interest rates, it also has primary responsibility for bank supervision.

The Fed is supposed to be quasi-independent, and so far it has preserved its interest-rate-setting independence in the face of intense pressure by Trump to cut rates. Yet a Trumpian agenda is attempting to overtake the Fed’s bank supervision operations. In June, Michelle Bowman, a Trump appointee, became the Fed’s vice-chair of supervision. She is in the process of reducing staffing at the Fed’s supervisory and regulatory unit by 30 percent, while hiring new staffers drawn from the banking industry.

Bowman is expected to substantially loosen capital requirements. Capital requirements – requirements that a bank’s shareholders put a significant amount of their own money at risk to fund loans, and not just depositors’ money – are a critical component of reducing risk throughout the banking sector. Bowman has also sent out a memo sharply curtailing the ability of Fed staff to issue warnings about what they consider risky bank practices.

While it’s impossible to predict the precise effect of any of these moves, Bowman’s actions will clearly increase the banking industry’s profits in the short run while increasing the risk of another financial crisis – a risk that will inevitably fall on taxpayers’ shoulders, as they did in 2008.

The second front of MAGA’s war on financial stability is on behalf of the crypto industry. The Trump administration and its allies in Congress — including, I’m sorry to say, a number of Democrats in this case — are moving to promote wider use of crypto. In particular, the GENIUS Act (gag me with an acronym), passed in July, aims to promote stablecoins. And the fact is that stablecoins are effectively an alternative, weakly regulated and poorly supervised form of banking.

What are stablecoins? They’re privately issued tokens supposedly fixed in value at one dollar. They are, in effect, sort of a digital version of the bank notes that circulated during America’s private banking era in the 19thcentury — an era in which gold coins were the only official U.S. currency, with paper money consisting of notes issued by private banks that promised to redeem these notes for gold or silver on demand. The most famous of these bank notes was the $10 “Dix” note issued by the Citizens’ Bank of Louisiana, which may have given the South its nickname:

Private banking had many serious problems: private banks frequently collapsed, thereby losing depositors’ money. Without effective government supervision, private banks could issue notes without the resources to honor their promise to redeem those notes on demand. Indeed, there was a proliferation of “wildcat banking” — establishing banks in remote locations “where the wildcats roamed,” thus making it difficult for noteholders to present their notes for redemption.

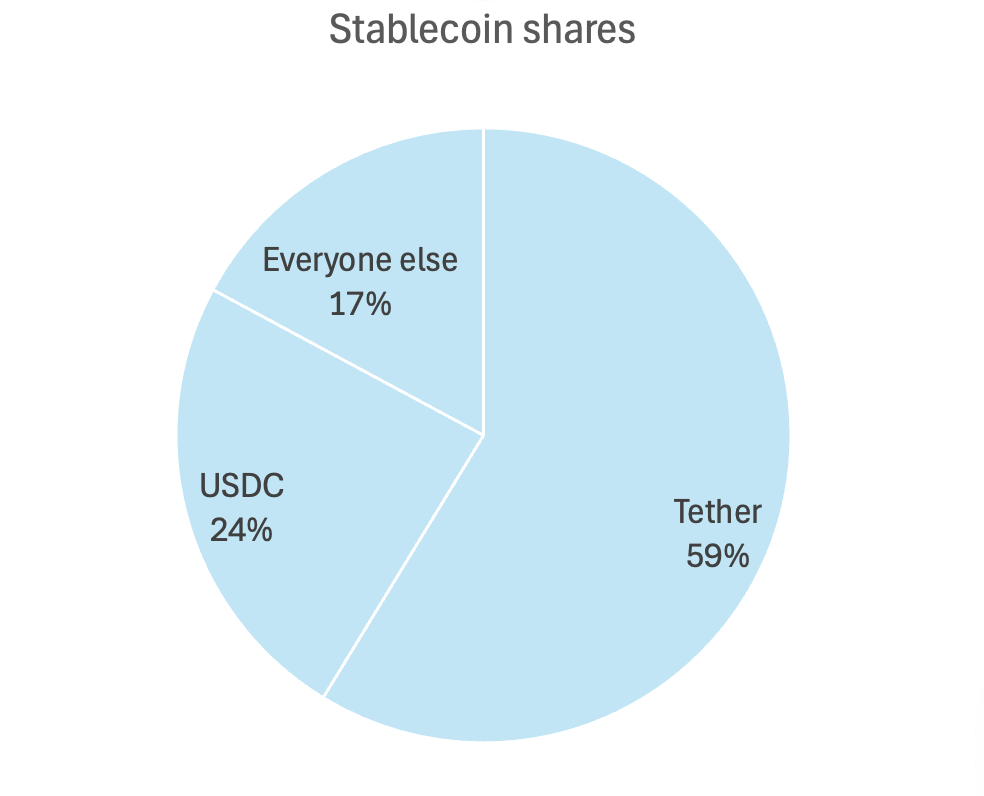

How do stablecoins compare with 19th century private banking? One fact rarely mentioned about the stablecoin industry is that it’s dominated by two big issuers, Tether and USDC, with the rest consisting of a grab-bag of minor coins that collectively are much smaller than either:

Tether has attracted the most scrutiny, in large part because it has, as The Economist puts it, become “money launderers’ dream currency.”

Leaving aside its role in facilitating global crime and viewing it as in effect a bank, how sound is Tether? On Wednesday S&P Global Ratings issued a scathing report, questioning the quality of Tether’s assets and noting that the company is highly secretive, giving outsiders no good way to assess its claims to be financially stable.

But aren’t government regulators keeping an eye on Tether? Um, no. Tether isn’t a U.S. company. It’s headquartered in and overseen by El Salvador, whose authoritarian ruler Nayib Bukele is best known in financial circles for his expensive, failing attempt to force Salvadorans to use Bitcoin as currency. El Salvador’s prudential guidelines for Tether are very lax, and how much faith do we have that even these weak rules are being enforced?

How did Tether respond to S&P’s assessment? With conspiracy theories, accusing S&P of being a tool of the “traditional finance propaganda machine.”

In short, as far as I can tell, Tether is a 21st century version of a wildcat bank, issuing tokens while deliberately making it hard for anyone to know whether it has the resources to honor them. And it’s not an outlier — it’s most of the industry.

Does Tether satisfy the rules of the GENIUS Act? No. This means that in principle, once the act is fully implemented, Tether won’t be able to issue its coins in the United States. The company has floated the idea of issuing a separate coin that does obey GENIUS rules, but that hasn’t happened yet.

Maybe other stablecoins will emerge that do honor U.S. rules. But there are worrisome loopholes in those rules that are likely to make stablecoins risky. And anyway, with resources and staff for financial supervision being slashed, how will these rules be enforced? A special source of concern is the worry that stablecoins will draw money out of conventional bank deposits into institutions that will, at best, be less well regulated.

Why are Trump and his allies undermining financial stability? There may be an element of free-market dogma. But as always with this administration, you shouldn’t underestimate the importance of simple corruption. Tether is closely connected with the financial firm Cantor Fitzgerald, formerly run by Howard Lutnick, Trump’s secretary of commerce. On joining the government, Lutnick left his role at Cantor Fitzgerald — and handed it over to his sons.

This post is already long, so I’ll stop with a warning: Along with its many other sins, the Trump administration is doing its best to make a future financial crisis more likely. I hope the Democrats are paying attention and won’t let themselves be seduced by Wall Street and, worse, the blandishments of the crypto bros. Because if they don’t, they could set themselves for a 2008-type crash during a Democratic administration. And we can guess who will get the blame.

MUSICAL CODA

Wildcat banks, cats, whatever

I have a personal direct interest in the Lehman Brothers debacle. My parents, who had very little wealth, had Lehman Brothers common stock as their largest single investment. They lost a large piece of their savings when it declared bankruptcy. But of course, the officers of Lehman Brothers (which did not include any members of the Lehman family by this time) did just fine. They had “earned” vast fortunes based on the size of the deals they made. That’s it - the SIZE of the deals they made…not the quality or security of those deals…just the number of zeros in those deals.

“Why are Trump and his allies undermining financial stability? There may be an element of free-market dogma. But as always with this administration, you shouldn’t underestimate the importance of simple corruption.” Thank you, Professor Krugman. Truer words were never spoken. I’m a disabled grandmother and clinical social worker who has engaged in more than 50 acts of disability-access microadvocacy (one issue and one organization at a time) across virtually all domains: Finance, Retail, Entertainment, Federal Government, State Government, Academia, Health Care, Nonprofit Safety Net, Media, Publishing, Insurance and Mainstream religion. In every case, the outcome was false hope, empty promises, and ignoring correspondence. The implied covenant of good faith and fair dealing has been replaced with “movie set” morality that appears real but is an illusion: each institution has formal policies in place that mandate truthfulness, transparency, and accountability but they’re subverted by internal legal teams in every single case. There is only one conclusion: this country has sustained a total moral collapse. We must demand reform.