So the Trump administration has triumphantly announced a trade deal with Japan, and I guess I should post something about it, even though my regular morning post — on a completely different topic — is already up.

There are three main things you should take away from this deal:

1. It will increase, not reduce, the U.S. trade deficit

2. It will accelerate America’s descent into crony capitalism

3. U.S. consumers are still facing a major price shock

The deal, as reported, involves imposing a tariff of “only” 15 percent on imports from Japan, mainly in return for a promise by the Japanese government to invest $550 billion in the United States. It appears that Japan will create a sovereign wealth fund for that purpose, and that Trump will have a say in how it invests.

So, first, the impact on the trade deficit. As I and others have repeatedly pointed out, there’s some basic arithmetic linking international investment and the trade balance. A few technical details aside,

U.S. trade deficit = Net foreign investment in the United States

This isn’t a theory, it’s just accounting. So if the deal leads to more investment in the U.S., it must, necessarily, lead to a bigger trade deficit.

How, exactly, would that work? The most likely channel is that capital inflow from Japan will lead to a stronger dollar than we would have had otherwise, making U.S. goods less competitive across the board.

It has been clear for a while that Trump and co. don’t understand or believe in balance of payments accounting, that they want both a smaller trade deficit and more foreign investment in America. Now their basic lack of understanding is embodied in a specific deal.

Second, as I said, it appears that Trump will get to influence how Japan invests. We’re already well on the way toward an economy in which success in business depends not on how good your product is but on your political influence (and also an economy in which Trump tells Coca-Cola what ingredients it should use.) This is another step on that road.

Finally, a 15 percent tariff is still really, really high — much higher than the 1.6 percent tariff Japanese non-agricultural exports faced before Trump began his trade war.

Will Japanese exporters, rather than U.S. consumers, end up paying that tariff? Some people have looked at the relatively muted effect of tariffs on consumer prices so far and suggested that maybe Trump was right about that. But they’re looking at the wrong data.

If foreigners were eating the tariffs, we’d expect to see a large decline in the prices America is paying for imports. And the BLS does, in fact, measure import prices; its index specifically does not include tariffs.

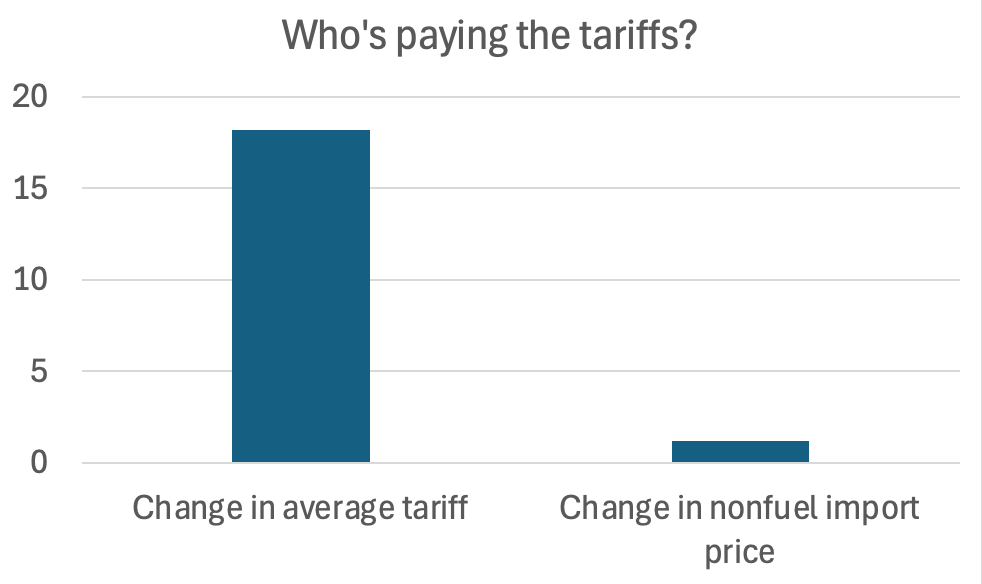

So let’s compare the increase in average tariffs from a year ago with the change in nonfuel import prices:

Source: Yale Budget Lab, Bureau of Labor Statistics

Have import prices fallen by enough to offset the tariff hikes? No, they’ve gone up slightly.

So why aren’t we seeing big increases in consumer prices yet? Basically because for the moment U.S. businesses are absorbing much of the cost rather than passing it on to consumers. They’ve been able to do that partly because many companies rushed to bring imports in before the tariffs hit, and are still selling out of that inventory. They’ve been willing to do that because they don’t want to alienate customers and lose market share, and have been hoping that the tariffs will mostly go away.

But if Japan still faces a 15 percent tariff after making a deal, that hope will soon fade. Winter Inflation is coming.

Update: Friends have been pointing out that this deal means that Japanese cars will pay 15 percent tariffs, while US car producers will still be paying 50 percent on imported steel. Not exactly a strategy to boost manufacturing. What were they thinking? They probably weren’t thinking.

Mike Judge's Idiocracy.

Once a dystopian satire, now a contemporary documentary.

It's unreal that we live in a world where they thumb their noses at basic math.