Despite hitting a few speed bumps, Congress seems likely to pass Donald Trump’s “big, beautiful bill” — legislation that combines big tax cuts for the rich with vicious cuts in social programs — within a few days. This momentous move will take place with almost no public discussion; the final hearing of the House Rules Committee began at 1 AM this morning. That’s right, 1 AM. We’re clearly watching a bum’s rush, an attempt to ram this atrocity through before the public understands what’s happening.

I have already focused on the bill’s cruelty. It’s also deeply irresponsible, undermining America’s hard-won reputation as a country that honors its obligations. The cuts to Medicaid and food stamps won’t come close to offsetting the revenue loss from the tax cuts for the rich. Neither will revenue from tariffs. And can we all now acknowledge that DOGE’s promise to eliminate hundreds of billions in “waste, fraud and abuse” hasn’t just failed? It has ended up being a complete waste of time, which it has tried to conceal with fraudulent claims of achievement, all while abusing dedicated civil servants and driving them out of government in ways that will impoverish America in the long run — and maybe not that long. We’re a world leader in education, science and technology that is systematically destroying the very basis of our success.

So we’re looking at a large increase in an already high budget deficit when we’re already at full employment, interest rates are already at multiyear highs, and future growth prospects are declining.

Financial markets normally cut wealthy nations with stable governments a lot of slack, with reason. Rich, well governed countries have immense ability to raise revenues if needed, especially if, like the United States, you collect a smaller percentage of GDP in taxes than almost any other advanced economy:

Source: OECD

In other words, until now markets have believed that the U.S. has the resources to deal with its deficit whenever it musters the political will. And bond buyers have been willing to assume that we are a serious country that will eventually get its fiscal house in order.

But markets’ patience with American dysfunction isn’t unlimited. Consider how quickly things went wrong for the UK. In 2022 Liz Truss, Britain’s Prime Minister, announced a “mini-budget” that involved cutting taxes and blowing up the budget deficit. Markets freaked out: long-term interest rates soared and the pound plunged. The tabloid The Daily Star famously set up a webcam showing a photo of Truss next to a head of iceberg lettuce wearing a wig, and asked which would last longer.

The lettuce won, because Britain’s parliamentary system allowed it to get rid of a disastrous leader. We, unfortunately, can’t.

So are we facing a Liz Truss moment in America? Long-term interest rates are close to their highest level in many years:

The dollar, which rose after Trump’s election, has now fallen sharply:

Source: xe.com

These market movements, especially in combination, are disturbing and at least hints that something like a Truss moment may be looming. We saw a whiff of that after Trump’s Liberation Day tariffs; what happens when markets realize that the budget is, in its own way, just as bad?

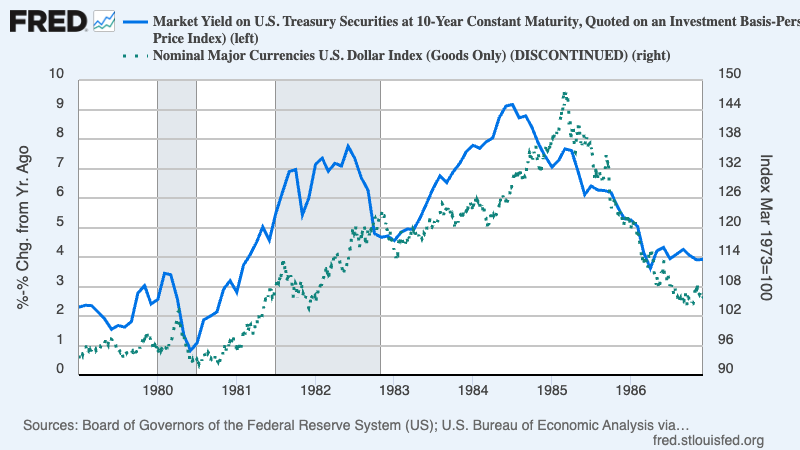

First, interest rates: deficit spending often does drive long-term interest rates up. But normally that’s because investors expect the spending to cause an inflationary boom, which the Federal Reserve will try to contain by raising short-term rates. That’s what happened when Ronald Reagan cut taxes while increasing military spending. Here’s an estimate of the real interest rate on 10-year bonds, where the real rate is the nominal rate minus expected inflation, which I proxy with actual core inflation over the previous year:

This time around most people expect the Fed to cut rather than raise short-term rates, because uncertainty over Trump’s tariff policies seems certain to cause an economic slowdown and possibly a recession. So why are long-term rates up?

Furthermore, a rise in U.S. interest rates normally causes the dollar to rise, as it did in the Reagan years. After all, higher rates should make investing in America more attractive, pulling in foreign capital and pushing the dollar up. But this time the dollar has been heading down.

So what’s going on? The Truss moment in Britain was partly caused by technical issues involving pension funds. But we may be facing technical issues of our own, especially involving hedge funds. In a larger sense Britain’s crisis was driven by a loss of credibility. Truss clearly believed in American-style voodoo economics, the belief that tax cuts have magical powers. Investors didn’t share that belief, so they effectively voted for the lettuce.

Unlike retail investors who are often driven by vibes, investment pros have clear doubts about Donald Trump’s credibility. The price of US credit default swaps — which are supposed to protect investors if America fails to honor its debt, and are an indicator of market pros’ sentiment — has surged:

Source: Worldgovernmentbonds.com

These market moves in bonds and swaps show that the Trump administration is losing credibility, just as the Truss government did. Professional investors are ceasing to treat us as a serious country.

Instead, they’re starting to treat us like an emerging market, where budget deficits are a sign that things are spinning out of control. This irresponsible bill is already being seen as a signal to sell America, leading to higher interest rates, increasing odds of a recession, and a weaker dollar. And the example of Britain shows that things could spiral out of control faster than almost anyone imagines.

MUSICAL CODA

GOOD THING THE MEDIA SPENT THE WHOLE WEEK TALKING ABOUT JOE BIDEN.

As Hemingway wrote in The Sun Also Rises: "How did you go bankrupt? Two ways: Gradually, then suddenly."